Pocket Option Analysis: Strategies and Techniques for Effective Trading

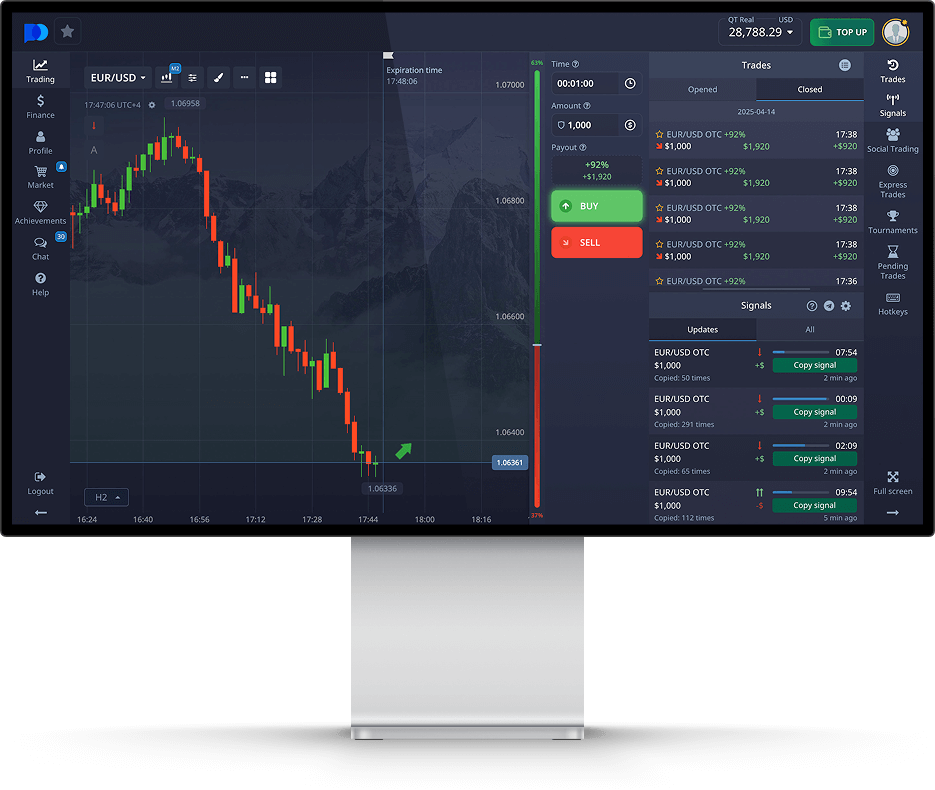

In the world of online trading, understanding market dynamics and executing well-informed decisions can be the keys to success. Pocket Option is a popular platform that offers traders a variety of tools and resources to analyze market movements. In this article, we will delve into the intricacies of Pocket Option Analysis and provide insights into how traders can master this platform. If you want to set up your charts effectively, you can visit this Pocket Option Analysis https://pocket-option.guide/nastrojka-i-analiz-grafikov/.

Understanding Pocket Option: An Overview

Pocket Option is a binary options trading platform that enables users to trade various assets ranging from currencies to commodities. Established in 2017, it quickly gained traction due to its user-friendly interface and innovative trading features. The platform supports both manual and automated trading, catering to a broader audience of traders. However, to succeed on Pocket Option, traders must acknowledge the importance of analysis in their trading strategy.

The Importance of Market Analysis in Trading

Market analysis is fundamental for making informed trading decisions. Regardless of the trading platform, understanding market trends, price movements, and indicators can significantly influence the outcomes of trades. In Pocket Option, traders can utilize various types of market analysis:

1. Technical Analysis

Technical analysis involves studying price charts and using indicators to forecast future price movements. Traders can employ tools such as moving averages, Bollinger Bands, and relative strength index (RSI) to identify trends and potential entry or exit points. Understanding chart patterns, like head and shoulders or double tops, can also aid in predicting price behavior.

2. Fundamental Analysis

Fundamental analysis focuses on economic indicators and the overall health of an economy. This includes analyzing factors such as interest rates, employment figures, and geopolitical events that could impact market prices. For traders on Pocket Option, keeping abreast of economic news can provide an edge in trading decisions.

3. Sentiment Analysis

Sentiment analysis gauges the overall mood of the market. Understanding whether traders are predominantly bullish or bearish can help in assessing market dynamics. Tools such as social media sentiment analysis and market news can aid in this type of analysis, allowing traders to align their strategies with market sentiment.

Using Indicators in Pocket Option Analysis

Indicators serve as crucial tools for traders on Pocket Option. They aid in the interpretation of market data and assist in making strategic decisions. Some commonly used indicators include:

1. Moving Averages

Moving averages smooth out price data to create a trend direction indicator. The two most common types are the Simple Moving Average (SMA) and Exponential Moving Average (EMA). Traders use these averages to identify the overall direction of the market and to spot potential reversal points.

2. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands (standard deviations away from the middle band). This tool helps traders identify volatility and potential price reversals. When the price touches the upper band, it may be a sign of overbought conditions, while touching the lower band could indicate oversold conditions.

3. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with levels above 70 typically signaling overbought conditions, while levels below 30 indicate oversold conditions. Traders can use this information to make informed decisions on entering or exiting trades.

Developing a Trading Strategy on Pocket Option

Having a solid trading strategy is essential for success on Pocket Option. Here are some steps to develop an effective strategy:

1. Define Trading Goals

Establish clear trading goals, whether they be short-term or long-term. Defining your risk tolerance and desired profits will guide your trading approach.

2. Choose Your Analysis Method

Decide whether to focus primarily on technical analysis, fundamental analysis, or a combination of the two. This will help in forming a structured approach to analyzing markets and entering trades.

3. Backtest Your Strategy

Before applying your strategy in a live environment, backtest it using historical data. This will help you understand its performance and make necessary adjustments.

4. Implement Risk Management

Risk management is a critical component of any trading strategy. Set stop-loss and take-profit levels to manage potential losses and secure profits.

Conclusion

Mastering Pocket Option Analysis is a vital aspect of becoming a successful trader on this platform. By applying both technical and fundamental analysis, utilizing indicators effectively, and developing a robust trading strategy, traders can improve their likelihood of success. Lastly, continuous learning and adaptation to market changes are essential for long-term achievement in the dynamic world of online trading. Embrace the tools at your disposal, analyze diligently, and trade wisely!

Leave a Reply